Here are the key points to remember :

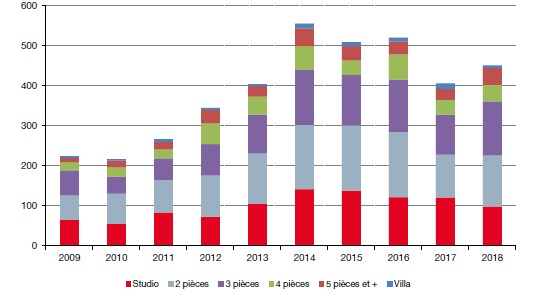

Chart showing the evolution of the number of resales by type of apartments

Regarding the “old” real estate market, there are 45 transactions more than in 2017, thus an increase of 11.1%. With 451 resales for 2 billion and 337 million euros, 2018 is the fourth best year since 2006. The number of transactions involving small apartments (studios or two rooms) is steady. It is the resale of larger apartments that is progressing and accounts for more than a quarter of transactions. Only transactions involving villas (most often acquired for real estate promotions) decrease.

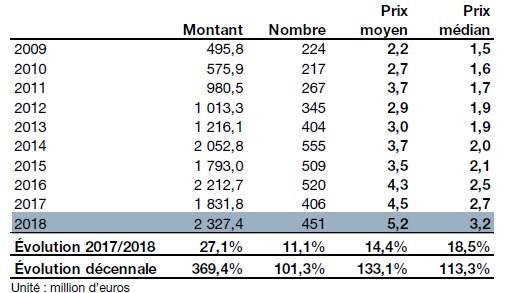

Evolution of the average and median prices of resales

The average and median prices of real estate sales are growing strongly. This is mainly due to the fact that sales of 5+ rooms increased by 53%, from 27 in 2017 to 43 in 2018, while at the sametime, studio sales dropped from 121 in 2012 to 99 in 2018.

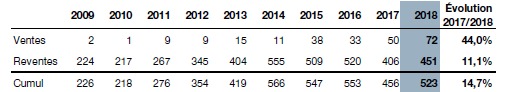

Evolution of the number of real estate sales and resales

While the numbers of sales and resales evolved in the same direction before 2014, this trend has not been confirmed since then, in particular when we are looking at the year 2017. Nevertheless, the number of resales rose again in 2018 (+14.7%) with a total of 523 transactions.

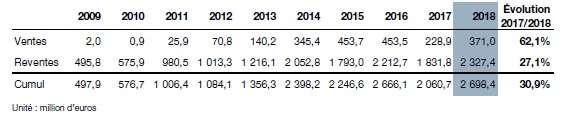

Evolution of the amount of sales and resales

The total amount of sales and resales has been consistently above 2 billion euros since 2014 with a total of 2 698.4 million euros in 2018. However, there has been a stabilization since then, with fluctuations from year to year but much less important than the exponential growth recorded between 2009 and 2014.

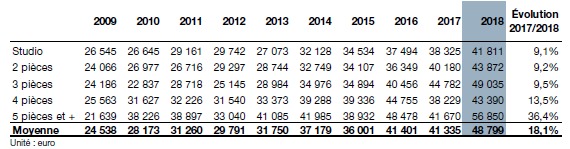

Evolution of the annual price of square meters by type of apartments

The average price per square meter increased on all types of apartments in 2018 (+ 18.1%) and now stands at 48,799 Euros. This raise is greater on "large" properties with a grow of 36.4% over those of 5 rooms and +.

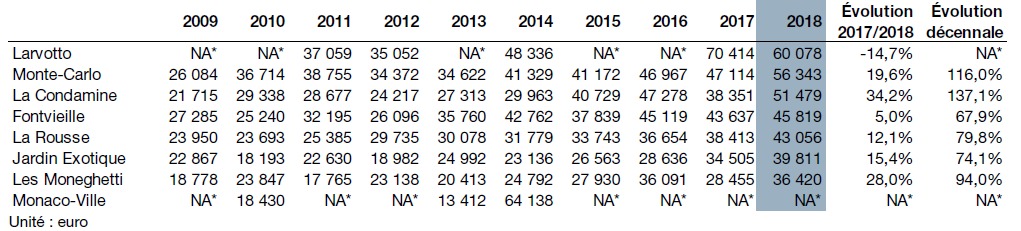

Evolution of the annual price per square meter per district

Only six neighborhoods have enough transactions to calculate the price per square meter every year. It is in Monte Carlo, with 56,343 Euros per square meter, that it is the highest. On the other hand, the lowest price per square meter is in the Jardin Exotique (36,420 €/m²).

The Larvotto district needs to be analyzed separately because there are very few transactions, often less than three and on some years even zero (2006 and 2008), but involving exceptional properties, which explains the high volatility.

In general, all prices per square meter increase regardless the district. What is interesting to note is that the rise was more important in the least expensive areas such as the Jardin Exotique, the Moneghetti and Condamine, although this district has benefited greatly from the delivery of the Stella building, which strongly impacted the registered square meter prices.

Conclusion:

The new program real estate market in 2018 in the Principality, focused on a single delivery with the building of middle standing, located in the Condamine and called “STELLA”. Therefore, given the small number of operations in the last three years, it appears difficult to comment these results. However, we can see in the coming years, a resurgence of the number new property programs of all sizes and in all areas and of which a large number will be intended for sale. Furthermore, a large part has already been booked and is now already on resale.

In the “old” real estate market, sales volume has been stabilizing for several years but prices continue to rise sharply.

On a daily basis, we notice a clear improvement of the quality of the apartments sold. Indeed, while the controls on residences have been strengthened, residents spend more and more time in Monaco and are accustomed to the high-end standards of international real estate, whether in terms of renovation works or in amenities and services available in the condominiums. Besides, the apartments offering generous surfaces are also coveted by these new families who settle in the Principality, often with home-based staff.

Upcoming trends :

Upcoming trends :

Positive points Negative points

|

|

|

The overall trend is good and prices should continue to rise, but in a fairly moderate way as well as the number of transactions in 2019 |

|