As it does every year, the Monegasque Institute of Statistics and Economic Studies (IMSEE), publishes the figures relating to real estate transactions, and more specifically those concerning the private residential sector as well as its ten-year evolution.

Introduction

During 2021, Monegasque real estate resumed its forward march, which had experienced a slowdown in 2020, largely related to the global pandemic.

Despite the permanent presence of COVID 19 in our daily lives, we have gradually adapted and become accustomed to it, especially during the summer season when sanitary restrictions have been relaxed, which has enabled an upturn in economic activity.

2021 has started very cautiously in line with the 2nd half of 2020, with only 98 transactions recorded in the 1st quarter, i.e. a decrease compared to 2020 of 4% in volume and 27% in value!

Nevertheless, from the second quarter onwards, activity has rebounded in terms of both volume and value, enabling an increase in the number of transactions (sales and resales) of approx. 7.1% compared to 2020, i.e. 29 more transactions, and an increase in volume from €2.172 billion in 2020 to €2.331 billion in 2021, i.e. a rise of 7.3%. Despite this, the historical records recorded in 2019 in terms of volume (€2.507 billion) and the number of transactions (452) were not reached.

In March 2021, we came to the conclusion that the health of Monegasque real estate depended in part on the evolution of the global health situation, but that we were nevertheless confident of its attractiveness in times of crisis. It has to be said that the year 2021 did not allow us to get rid of all the restrictions linked to COVID 19, which remained and lasted throughout the year. The strong post-pandemic rebound that we had hoped for has therefore not yet occurred.

We also explained that because of the safe haven represented by property investment, combined with low bank interest rates, and the specific characteristics of Monaco which reassure and benefit from the uncertainty of neighbouring countries, we were very confident about the attractiveness of the Monegasque market. This was confirmed at all levels and even more so when it came to the price per square metre, which for the first time broke the €50,000 barrier on average for resales, reaching €51,912!

The Monegaque residential property market

Evolution of the cumulated amount and number of property transactions

In 2021, 23 sales and 417 resales were recorded, for a total of 440 transactions. This represents an increase of 7.1% compared to 2020, but is still lower than what has been observed since 2014, when the 500 transaction mark was crossed on four occasions. In terms of cumulative value, the figure for 2021 is €2.331 billion, i.e. an increase of 7.3% compared with 2020 but a decrease of 7% compared with 2019.

Ten-year evolution of the average price of a property transaction

In 2021, the average price of resales increases slightly while that of new flats has fallen due to the type and standard of the properties sold. The situation is reversed in relation to 2019, with a fall in the average price of resales and an increase in the average price of sales.

A/ The property sales market

Ten-year delivery of new apartments in the private sector

Over the last decade, 557 new flats have been delivered, including 90 in 2021. Despite this significant delivery, only 23 sales have been recorded, 30% of which are off plan. There are two reasons for this: the first is that the Mona Residence project, which totals 62 units, has been retained almost entirely by the developers, as have the Villa Parana and Villa Esmeralda (total of 3 units). The only operation that was really marketed was Villa Palazzino, for which 25 units were taken. The second reason is that the purchase commitments are often signed well in advance of delivery as soon as the marketing is announced.

However, the number of sales has increased compared to 2020 (+7 units or +44%).

Ten-year evolution in the amount of sales by type of apartment

At the same time, the amount of sales only increased by 8% compared to 2020 to reach €235.6 million due to the fact that 17 of the 23 units sold were 2-bedroom flats or less and that the main Villa Palazzino operation recorded a lower average price per sqm than the majority of the latest or future developments.

This is still a far cry from the record set in 2018 in terms of number of sales with 72 units or that of 2015 in terms of sales value with €453.5 million.

Ten-year evolution in the number of sales and resales

For the same reasons as mentioned above and directly related to the type of flats delivered, the average price decreases by 25% and the median price by 11% vs. 2020, but this is not significant, and it is impossible to draw conclusions by highlighting only these data.

B/ The property resales market

-

Global market

Ten-year evolution of the number of resales by type of apartment

The resales repartition according to the type of flat in 2021 is quite similar to that observed in 2020, with the exception of transactions involving large units, which have seen an increase of 41.7%, i.e. 10 units more, as have 1-bedroom apartments, but for which this represents a proportional increase of 8.4%. Studios and 1-bedroom properties represent 243 resales, i.e. more than 58% of the types of properties sold, as in 2020.

Ten-year evolution of the amount of resales by type of apartment

The cumulative amount of resales is back above the €2 billion mark, just like in 2016, 2018 and 2019. Nevertheless, 2021 is still 15.3% below the peak recorded in 2019.

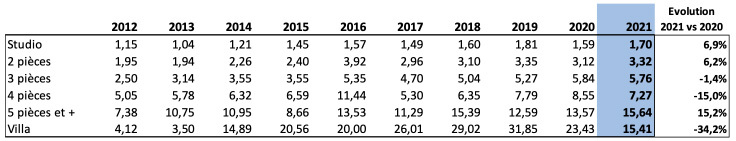

Evolution of average resale prices by type of apartment

Unité : million d'euros – tableau créé par VALERI AGENCY

We note that Studios and 1-bedroom apartments have seen an increase in their average price in 2021 vs. 2020 and will return to prices close to those observed in 2019, which were a record. As for the 4-bedroom and more apartments, they will reach a new record average price in 2021, attaining €15.64 million, while the 4-bedroom apartments will see a 15% decrease. Villa prices have fallen significantly to an average of €15.4 million.

Number of apartment resales by year and price range

The price bracket that has seen the biggest changes between 2020 and 2021 is for transactions between €5 and €10 million. Indeed, the average price for this type of flat has risen, and some resales previously credited in the under €5 million bracket have had to switch. In proportion, this bracket now represents 22.5% of the resales total number compared to 18.5% in 2020 and 18.8% in 2019. The number of transactions involving exceptional properties continues to fall both in absolute value and in proportion.

Ten-year evolution of average and median resale prices

Slight increase in the average price from €4.9 million in 2020 to €5 million in 2021 (+1.6% vs 2020). The same applies to the median price, rising from €3.1 million to €3.2 million (+1.6%). This is still well below the 2019 level (-12.9%). One in two transactions is for a property worth more than €3.2 million.

Ten-year evolution of the price per square meter by type of apartment

Between 2020 and 2021, the price per square metre will increase by 9% to cross the symbolic €50,000 barrier for the first time! Only properties with less than three rooms remain below €50,000 per square metre, while those with five rooms or more have passed the €60,000 per square metre barrier.

Ten-year evolution in the average price per sqm and the cumulative property resales amount

The average resale price has been increasing steadily. It is interesting to note that it increases in stages every two years, with the exception of 2018, 2019 and 2020, when an exogenous factor (global pandemic linked to COVID 19) led to prices stagnation for three years.

In terms of the cumulative amount of resales, we observe more volatility but no clear trend. The level reached in 2021 is roughly the same as that recorded in 2014.

There is a relatively simple explanation for this difference in the evolution of the cumulative amounts of resales and their average price, which is that supply tends to become scarcer while at the same time demand increases, resulting in an exponential inflation of average prices. Moreover, the wealthy financial profile of HNWI sellers means that they rarely need cash urgently, and because of the disproportion between supply and demand, they are the ones who set their prices and they are generally unbending...

-

By district

Distribution of the property resales number by district in 2021

Ten-year evolution on the property resales number by district

Unsurprisingly, the Monte Carlo district is the one that has recorded the highest number of resales, with no real difference compared to 2020 (134 vs 135 in 2020). The same applies to La Rousse-Saint Roman (-3.8% vs 2020).

On the other hand, it is the Condamine district that has recorded the strongest increase with 48 transactions, i.e. one (+71.4% vs. 2020), and which is now in the top three. Monaco-Ville, although with a very low volume, has seen an increase of (+50% vs 2020). Fontvieille, a very fashionable district which, in 2020, had overtaken Monte Carlo in terms of price per sqm , continues to attract new residents, increasing from 35 transactions in 2020 to 43 (+22.9% vs 2020).

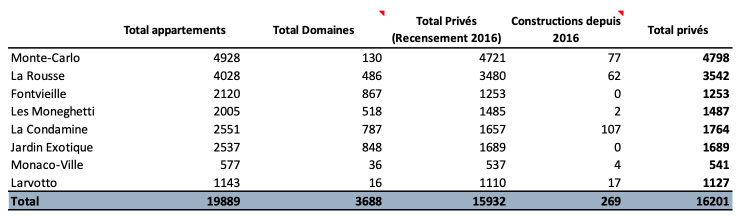

Number and surface of buildings per district on 1 January 2022

Housing, including state-owned housing, represents 61% of the surface area built in the Principality. Nearly 43% of the surface area built for residential use is located in the districts of Monte-Carlo (24.1%) and La Rousse (18.8%).

Number of dwellings per district in 2021

Graphic provided by VALERI AGENCY

State-owned housing reserved for Monegasques as well as that of the Caisse autonome des Retraites for certain categories of population are excluded from the analyses as they cannot be subject to a transaction (only of a so-called housing-capitalization contract between the State and the occupants for state-owned housing). Most of these dwellings are located in the districts of Fontvieille, Moneghetti, Jardin Exotique and La Condamine.

It can be seen that Monte-Carlo and La Rousse has a total of 8,340 private dwellings, i.e. more than 51% of the total number of dwellings in Monaco.

Pourcentage of available housing sold by district in 2021

Graphic provided by VALERI AGENCY

Fontvieille is the district in 2021 that has recorded the highest turnover with 3.43% of available housing sold. Conversely, we note that Larvotto is the district with the least turnover, which is motivated by the fact that the vast majority of flats are owned by a few families who keep them as part of their estate, as is the case in Monaco-Ville, but to a lesser extent.

Average price per sqm of a property resale by strict in 2021

Ten-year evolution of the price per square meter per district

In some areas, the number of transactions is too low to be calculated.

The Monte-Carlo district takes over the 1st place as the most expensive district, followed closely by Fontvielle and the Larvotto. Monte-Carlo, Fontvieille and La Rousse are the areas that have seen the greatest increase in price over the past year. In 10 years it is Fontvieille that has seen the most spectacular growth in its price per square metre, as it has risen by 125.5%, while Monte Carlo has risen by 74.5%.

Conclusion

Economic activity in Monaco during the first few months is very dynamic, as is the property market. This dynamism should continue throughout the year with the gradual end of the various restrictions linked to Covid-19, which we hope will not be revived in the coming months.

Another interesting metric is that current rents are gradually returning to their 2019 levels, but there are still some difficulties in re-letting exceptional properties that are being offered above the €30,000 monthly rent.

Luxury real estate around the world has been growing very well, supported in particular by the perpetual increase in UHNWIs and HNWIs and their wealth. However, the current unstable political and fiscal context in Europe does not inspire real estate investors, who need to have medium to long-term visibility.

Indeed, public debt continues to grow in many countries with structural deficits, which have not been spared by the global pandemic and whose expected tax reforms should weigh on real estate. Moreover, the risk of social breakdown is more present than ever and even if the various protest movements observed in certain countries before the appearance of Covid 19 have subsided, they should re-emerge soon. Thus, the specificities of Monaco should attract many candidates to take up residence, reinforcing the attractiveness of Monaco.

The renewal and modernisation of the Monegasque property stock will make it possible to accompany this growth and propose an offer that is more in line with legitimate expectations given the prices charged by international buyers.

On the other hand, it will be necessary to observe the legislative evolution in Monaco concerning the regulation of the property dealer profession, where a draft law is likely to be voted in the coming months. A minimum of work would be imposed in correlation with the purchase price, ten-year insurance would become compulsory, and a transfer duty would be applied. The number of operations purchased through this regime should therefore normally be reduced, which could have an impact on the number of transactions that have been strongly fuelled in recent years thanks to this profession.

The geopolitical context in Europe, with the outbreak of the Russian-Ukrainian conflict on 20 February, gives rise to fears of a possible escalation and should accelerate inflation, particularly in certain raw materials, notably in the food sector, as well as in energy, of which these two countries are major exporters for neighbouring countries. In order to curb post-crisis inflation, the central banks should raise key interest rates, which would increase the cost of bank financing for future buyers and weigh on real estate investments. Finally, the Russian-speaking community, which is very present in the Principality and active in the property market, particularly in the field of exceptional properties, should hold back on their investment decisions during the time of the conflict and the international sanctions, which could generate some movement on resale for those who encounter liquidity problems.

Finally, the Monegasque property market should perform well this year with strong demand but depending on the evolution of the various elements mentioned above over the next few months, it might slow down. Transactions involving exceptional properties in excess of 20 million euros should also encounter some difficulties.

In 2021, in addition to the activities that we were already offering with my team, i.e. transactions, rental management and co-ownership management, we were privileged to be accredited as real estate valuers by the Centre National de l'Expertise.

The whole team and myself are at your disposal, both in our Monegasque agency and in our French agency, to help you in all your real estate projects in the Principality of Monaco and the surrounding areas.

Monaco, 26 April 2022,

Florian VALERI

Researches completed by VALERI AGENCY