Monegasque residential property observatory 2022

Methodological Note

As it does each year, the Monaco Statistics and Economic Studies Institute (IMSEE) publishes the figures relating to property transactions in its Real Estate Observatory, with a particular focus on the private residential sector and a decade-long perspective on market trends. Sales concluded as life annuity agreements are not included.

The data on sales and resales is based on transactions recorded by the Mortgage Division of the Tax Services Department.

The price per square metre is calculated using the standard methodology applied in Monaco, based on the external dimensions of façade walls and the centre line of walls separating common areas within a building. It is important to note that surface areas are not always known. Balconies and loggias are counted at 100%, while roof terraces and gardens are included at 50%.

INTRODUCTION

The Monegasque residential property market, by its very nature unique, entered 2024 with a contrasting dynamic, marked by a striking duality between the new-build and resale segments. While overall sales reached record highs — driven in part by the delivery of the offshore extension Mareterra — the secondary market saw a decline in volume, reflecting a more cautious environment.

In the face of global uncertainty — from geopolitical tensions to financial market volatility and the repositioning of wealth strategies among (U)HNWI investors — Monaco’s market once again demonstrated its resilience. Despite a slight drop in the number of transactions, price per square metre remained exceptionally high, buoyed by sustained demand for exceptional properties and an increasingly scarce supply. This ability to preserve asset value and attract international buyers seeking stability continues to cement Monaco’s standing as a premier property destination in Europe.

This position was further reinforced by Monaco’s ranking in 4th place in the latest Barnes Global Property Handbook, which lists the Principality among the most sought-after locations for the world’s wealthiest individuals.

Through this Observatory, we offer a detailed analysis of the 2024 figures, examining the data from every angle to better understand current market dynamics and anticipate future developments.

GLOBAL VISION

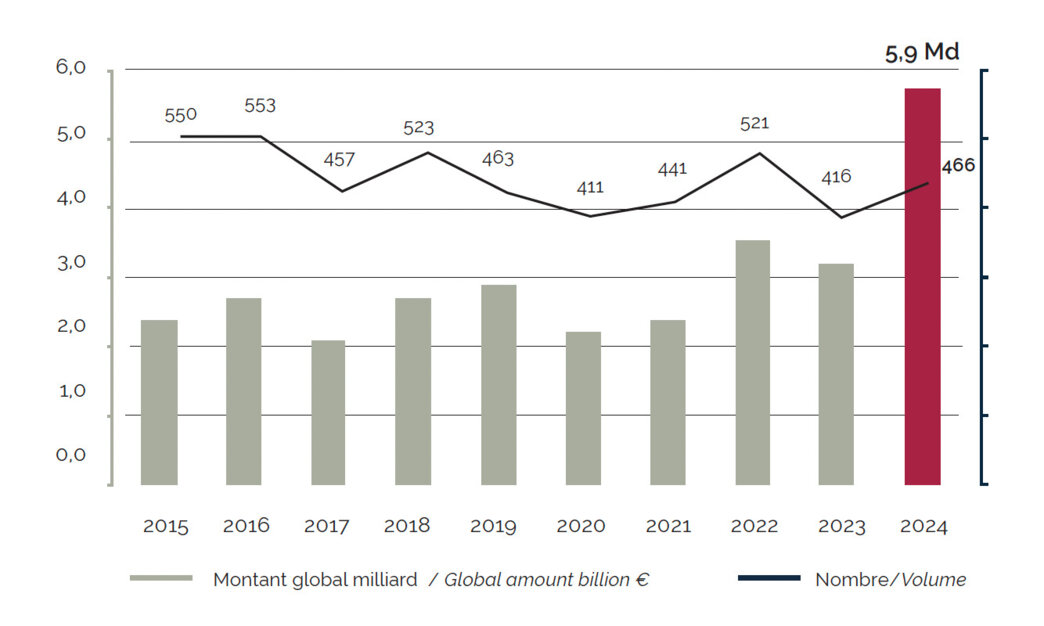

Trends in Property Transaction Volumes and Values

The Monegasque residential property market recorded a total of 466 transactions in 2024, comprising 101 new-build sales and 365 resales — an increase compared to 416 transactions in 2023. This growth, representing a rise of approximately 12%, was largely driven by the high number of new-build sales, particularly following the completion of Mareterra in December 2024. In contrast, the number of resales declined by 5.9%. It is worth noting that the average annual number of transactions over the past decade stands at 489.

More striking than the increase in the number of transactions is the record-high cumulative transaction value, which reached €5.9 billion in 2024 — a remarkable 82.6% rise compared to €3.23 billion in 2023. Two-thirds of this total came from new-build sales. This sharp increase reflects higher average transaction values than in previous years.

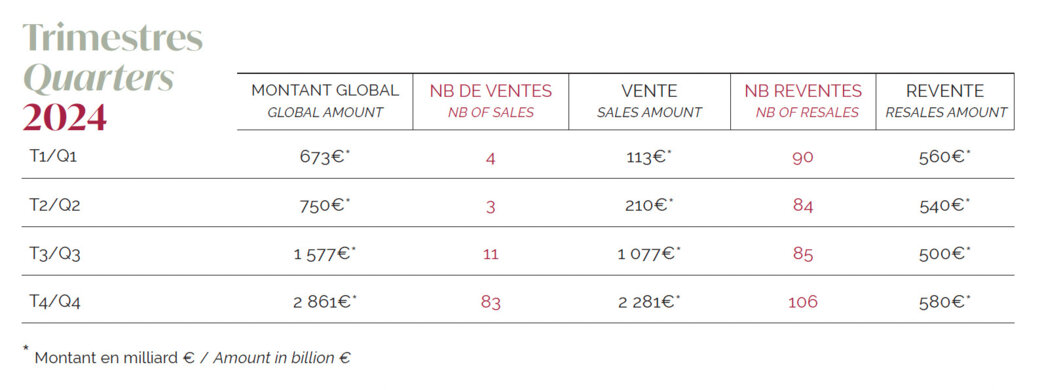

End-of-2023 trends carried over into early 2024, with activity remaining limited during the first two quarters. A recovery emerged in Q3, driven primarily by new-build sales, before surging in the final quarter with 83 new-build transactions recorded in Q4 alone.

By contrast, the resale market remained stable throughout the year, with quarterly transaction numbers ranging between 84 and 106, and transaction values of approximately €500 million.

THE PROPERTY SALE MARKET

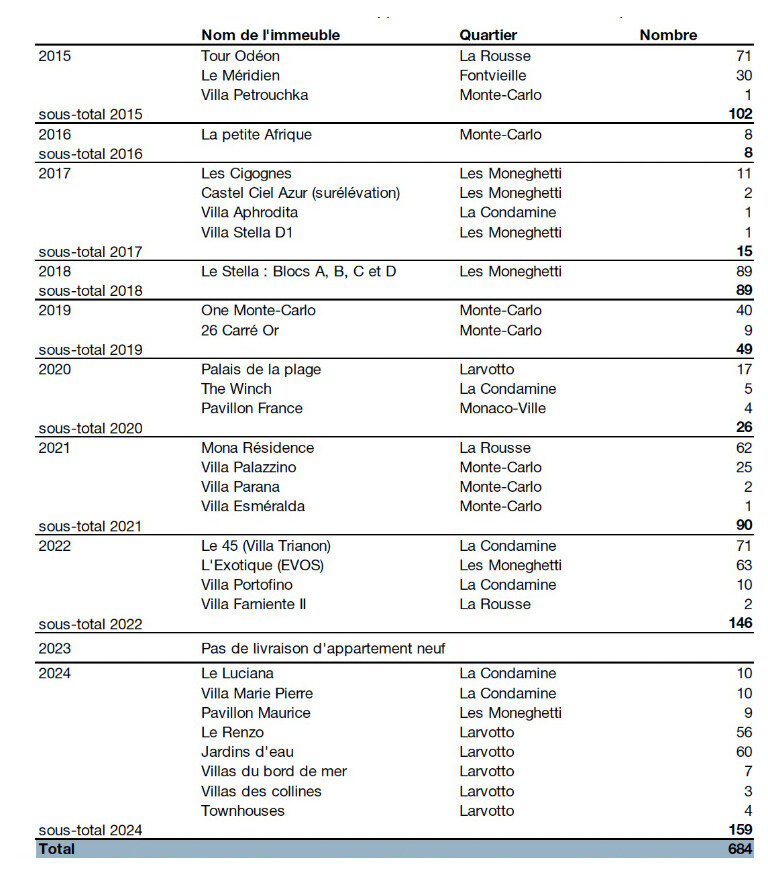

After a year with no new apartment deliveries in 2023, 2024 sets a historic record with 159 units completed. This sharp increase is largely attributable to the Mareterra development, which alone accounts for 130 units.

The outlook for 2025 also points to a strong pipeline, with several major residential projects due for completion, including Villa Ninetta, Bay House, and L’Écrin de Malachite — all of which are set to further strengthen the new-build offering in Monaco’s property market.

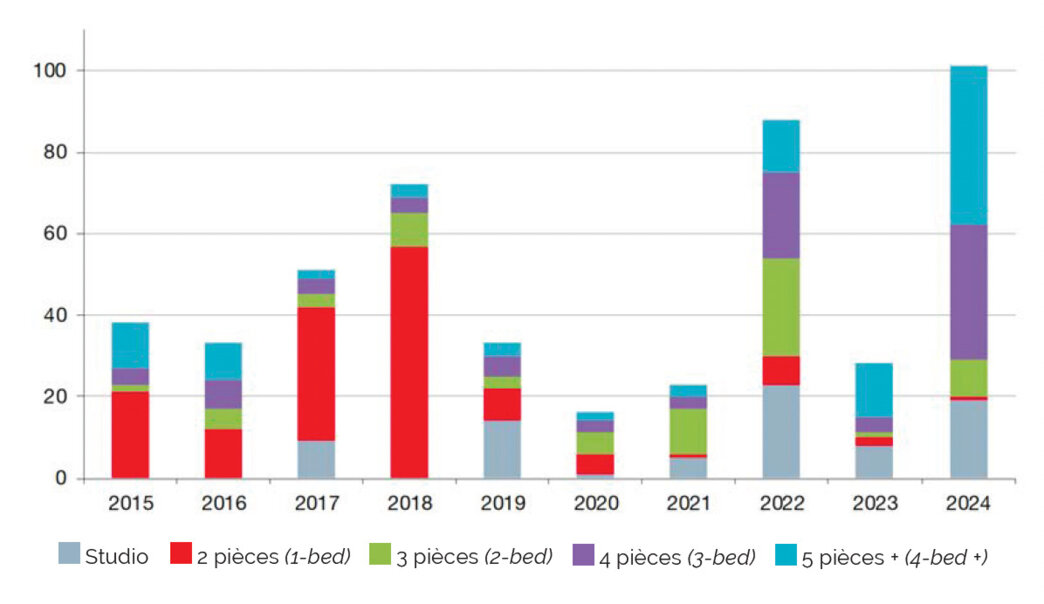

Ten-year Evolution in the Number of Sales by Type of Flat

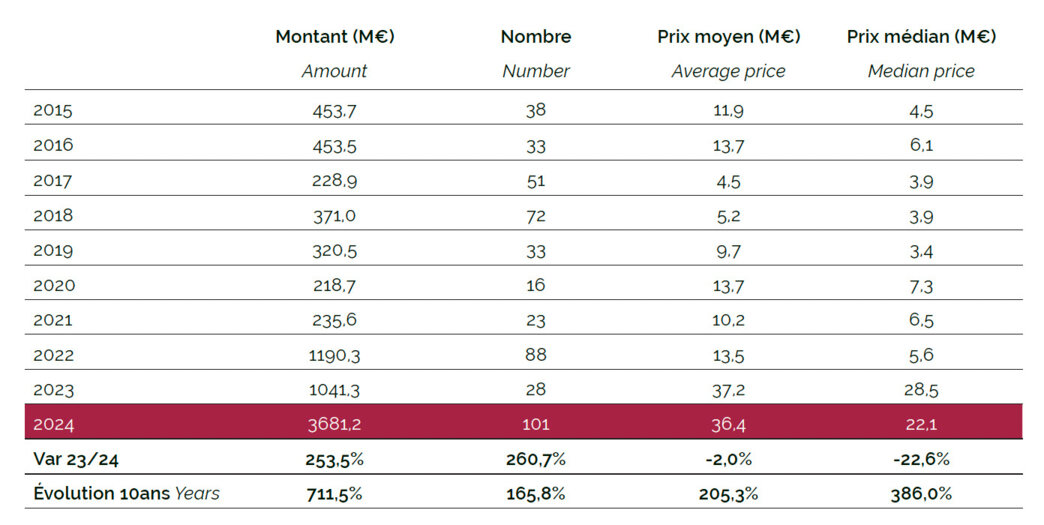

Sales also reached an all-time high, with 101 new-build transactions — the highest figure ever recorded since data has been tracked. This surpasses previous peaks, notably in 2015 with the delivery of the Tour Odéon, and in 2022 with 45G and L’Exotique.

Among the units sold, a strong trend observed since 2022 continues: demand is increasingly focused on larger apartment typologies. Properties with 4 or more rooms, including villas, accounted for over 70% of all new-build sales — a total of 72 units.

As for smaller typologies, it is worth noting that 18 out of the 19 studios sold were acquired alongside larger properties, often for use by household staff.

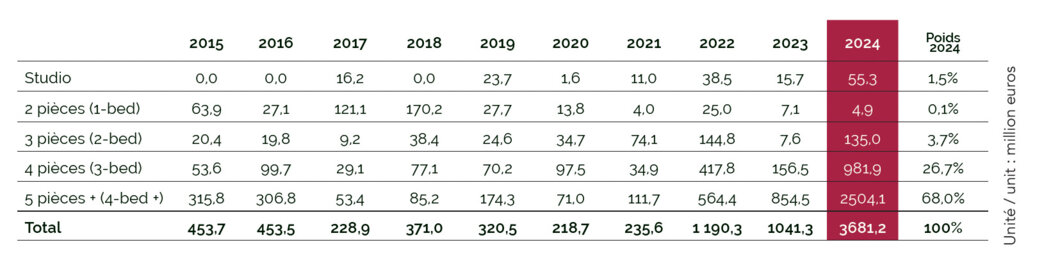

Ten-year Evolution in the Amount of Sales by Type of Flat

In 2024, the Monegasque property market reached an unprecedented high, with sales volumes totalling €3.7 billion — more than three times the previous record set in 2022 (€1.2 billion). Remarkably, this figure exceeds the cumulative total of all transactions recorded between 2006 and 2021.

This surge has been largely fuelled by demand for exceptional, high-end properties. 3-bedroom flats alone accounted for nearly €1 billion in sales, while transactions involving 4-bedroom properties and above exceeded €2.5 billion, including almost €1 billion for villas. Together, these segments represent almost 95% of the total transaction volume.

The trend towards ultra-luxury continues to gain traction thanks in particular to Mareterra, whose exclusive positioning has played a central role in driving the exceptional market performance seen in 2024.

Ten-year Trend of Average and Median Prices for a Sale

The average and median prices recorded a slight decrease compared to 2022 (-2% and -22.6%, respectively), reaching €36.4 million and €22.1 million. Nevertheless, both remain significantly higher than in previous years.

Interestingly, despite a steeper decline in the median price compared to the average, it still stands at four times the level recorded in 2022. This is partly due to the typology of the properties sold, and partly to the quality and high standing of the developments recently completed or currently under construction.

More than half of all units sold exceeded €22 million, including seven villas sold for over €100 million.

Given that the vast majority of these results stem directly from ongoing developments, it is difficult to draw definitive conclusions — except that developers are clearly favouring large, high-end properties, and appear to have no difficulty finding buyers.

This demand was identified as early as a decade ago, and it had become essential to meet it in light of the changing profile of Monaco’s new residents: increasingly younger, and spending more time in the Principality than in the past.

It was also necessary to align with international property standards, which such clientele naturally expect given the price levels at play.

THE RESALE PROPERTY MARKET

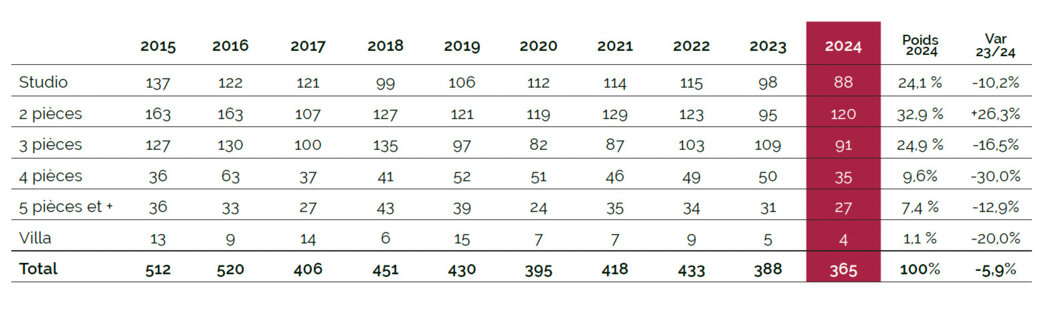

Ten-year Evolution in the Number of Resales by Type of Flat

With 365 transactions in 2024, the resale property market has seen a decline for the second consecutive year (-5.9%), reaching its lowest level since 2012.

All apartment typologies recorded a drop in transaction numbers, except for 1-bedroom flats, which saw an increase of nearly 26%. Last year, we observed a significant slowdown in smaller units, due to reduced activity from investors in 2023. The steepest declines were recorded in 2-bedroom and 3-bedroom flats, with decreases of 16.5% and 30%, respectively.

The overall trend continues to reflect a general slowdown in the resale market, in line with patterns seen in recent years — with the notable exception of one-bedroom flats, which reaffirm their position as a safe haven for investors.

Ten-year Evolution in the Amount of Resales by Type of Flat

In contrast to the surge observed in new-build sales (+253% in 2023), the total value of resales remained stable in 2024, recording only a slight decrease of 0.6%, for a total of €2.18 billion. This stability is largely due to a significant rise in 1-bedroom resales, which increased by 36.6% and now account for around 20% of all resale transactions — effectively offsetting the decline in other property types.

However, the change in total transaction value between 2023 and 2024 was less pronounced than the decline in the number of transactions, further underscoring the fact that average acquisition prices continue to rise.

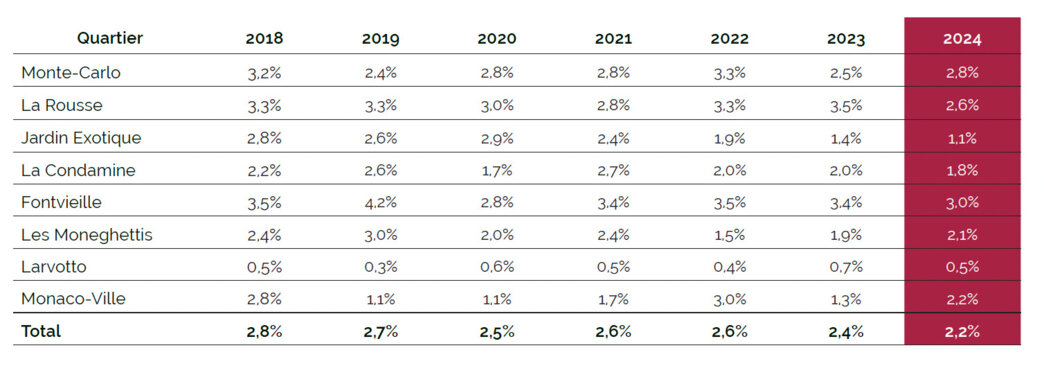

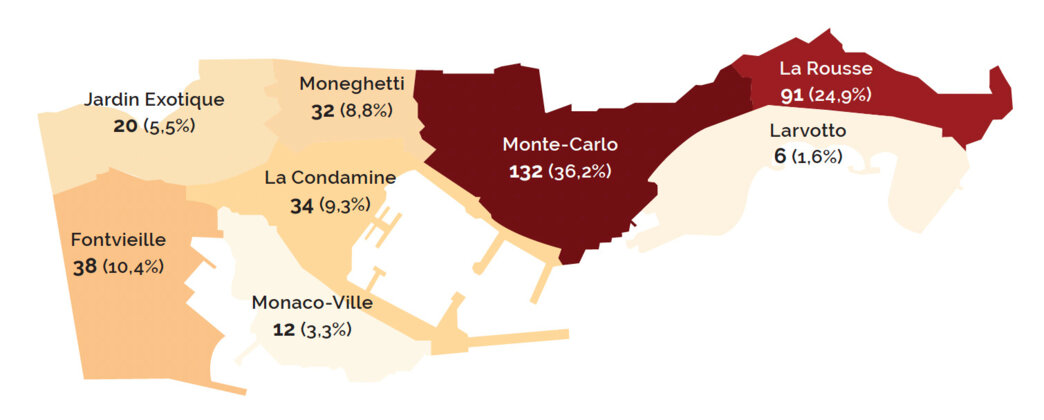

Share of Existing Private Housing Sold by District

Unlike in 2023, it was Fontvieille that recorded the highest turnover in 2024, with 3% of existing private dwellings sold. The Monte-Carlo district remains highly dynamic and follows closely behind, at 2.8%.

At the other end of the spectrum, Larvotto recorded the lowest level of activity, largely due to the fact that most buildings there are held as part of family estates by major property-owning families. Even with the arrival of Mareterra, this situation is unlikely to change significantly in the future.

It is also worth noting that La Rousse saw a decrease in resale activity, with only 2.6% of its existing private stock changing hands, compared to 3.5% the previous year.

Year after year, the districts that consistently show the highest rates of turnover are Monte-Carlo, La Rousse, and Fontvieille.

Breakdown of property resales by district: volume and relative shares

61.1% of all resales in 2024 took place in the districts of La Rousse and Monte-Carlo, compared to 62.4% in 2023 — this, despite a sharp drop in activity in La Rousse, which recorded 32 fewer transactions (-26%). It is worth noting that Monte-Carlo and La Rousse together account for over 51% of Monaco’s total housing stock.

While the number of resales increased in Monte-Carlo, Les Moneghetti, and Monaco-Ville, all other districts saw a decline in activity.

Ten-year Trend in Average Resale rices by Flat Type / Median and Average Price in 2024

In 2024, the average resale price rose by 5.7%, reaching €6 million, compared to €5.7 million in 2023, and setting a new all-time high, surpassing the previous record of €5.8 million in 2019.

In 2024, the average resale price rose by 5.7%, reaching €6 million, compared to €5.7 million in 2023, and setting a new all-time high, surpassing the previous record of €5.8 million in 2019.

The median price also climbed to its highest level ever recorded. In 2024, more than half of all resales were concluded at €3.6 million or above.

All property types saw their average prices increase. The smallest units — studios and 1-bedroom flats — posted the modest growth of +6.7%, with average prices reaching €1.9 million and €3.6 million, respectively. The strongest increase was recorded for 3-bedroom apartments, with a rise of 20.5%. In 2024, the average price of a 3-bedroom flat stood at €11.2 million. Villas, due to their scarcity and the limited number of transactions, form a very specific segment. This year, their average price soared by 89.8%.

Over the past decade, the average and median resale prices have increased by 66.7% and 67.4%, respectively.

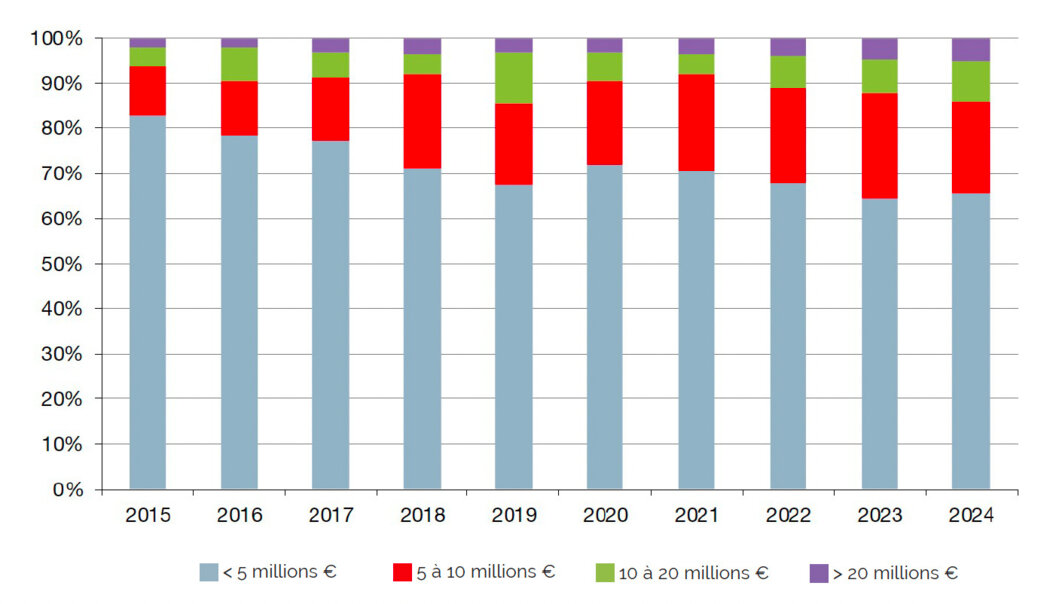

Number of Resales by Year and Price Bracket

In 2015, resales below €5 million accounted for just over 80% of the total transaction value. By 2024, this share had dropped to less than 65%. Over the past decade, transactions under €5 million have declined by 43.6%, representing 185 fewer deals.

Conversely, although the increase is moderate, sales above €10 million rose by 10.6% compared to 2023. Notably, nearly 5% of resales in 2024 — 19 apartments — exceeded €20 million, setting a new record and surpassing the previous high reached in 2023.

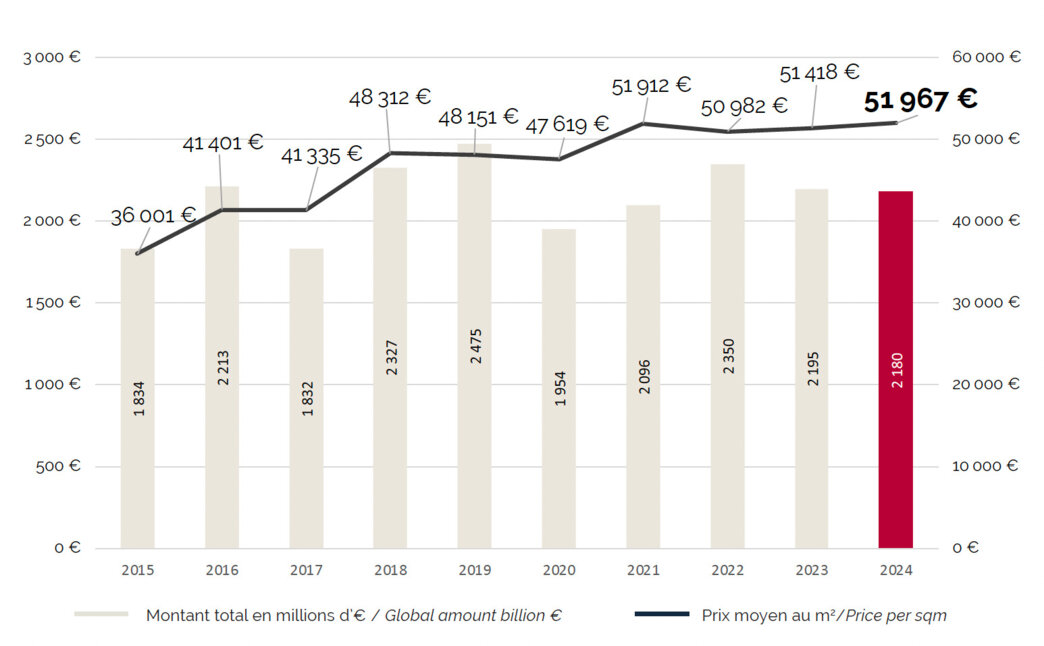

Ten-year trend in the average price per Sq.m & the cumulative resales amount

The resale market in Monaco has shown a mixed trajectory over the past decade. After peaking in 2019 (€2.475 billion), the market experienced a downturn in 2020 (€1.954 billion) due to the pandemic. A recovery began in 2021, culminating at €2.350 billion in 2022, followed by a slight dip in 2023 (€2.194 billion) and a stabilisation in 2024 (€2.179 billion).

Despite these fluctuations, the market has demonstrated a notable resilience, consistently fluctuating between €2 and €2.5 billion in transaction value from year to year.

At the same time, the average price per square metre has continued to rise steadily, increasing from €37,242/m² in 2014 to €51,967/m² in 2024 — a nearly 40% increase.

Two distinct phases stand out: a sharp rise between 2017 and 2019 (+16.5% in two years), and another between 2021 and 2024, during which the €50,000/m² threshold was surpassed, followed by a slight upward stabilisation.

This trend reflects a sustained demand for increasingly exclusive properties, combined with limited supply and the upmarket transformation of Monaco’s housing stock — as illustrated by four-bedroom apartments, where transaction volumes fell by 30%, while average prices per transaction rose by 20%.

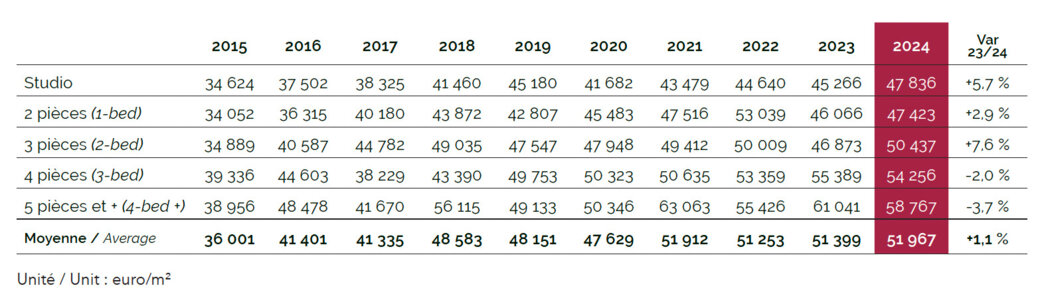

Ten-year trend in the average price per Sq.m by flat type

In 2024, price per square metre evolved differently across property types. Studios and 2-bedroom apartments recorded the strongest increases, with rises of +5.7% (€47,836/m²) and +7.6% (€50,437/m²) respectively. 1-bedroom units also saw growth of +2.9% (€47,423/m²).

This momentum marks a rebound for 1- and 2-bedroom flats, which had been the only categories to decline in 2023. Demand for these formats appears to have strengthened — particularly for investment purchases or complementary units to larger residences.

By contrast, larger properties experienced a slight downturn. The average price per square metre for four-bedroom flats dropped by 2% (€54,256/m²), while 4-bedroom units and above saw a more pronounced decline of 3.7% (€58,767/m²).

This trend may reflect a market shift back towards more compact properties, following several years of sharp increases in large-unit prices, and the limited supply of such properties on the resale market. Despite this decline, these segments still command exceptionally high values, confirming their ultra-premium positioning.

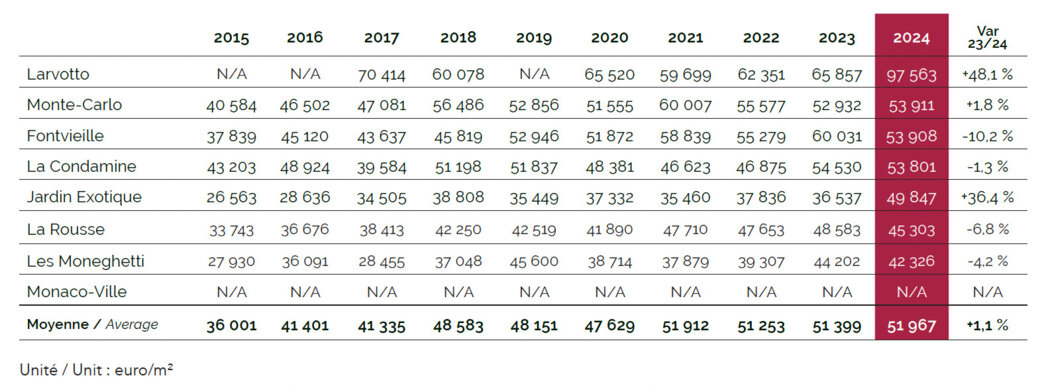

Ten-year trend in the average price per Sq.m by district

In 2024, the average price per square metre in Larvotto reached €97,563, setting a new record for any district — a 48.1% increase. This figure should be viewed with some caution, as it is based on a limited number of transactions (just six); however, it clearly reflects the increasing exclusivity of the area. Historically made up largely of rental properties, Larvotto is expected to see growing transaction volumes with the integration of Mareterra, while maintaining some of the highest — if not the highest — property prices in the Principality.

Monte-Carlo ranks second, behind Larvotto, with an average price of €53,911/m² (+1.8%), closely followed by Fontvieille (€53,908/m²) and La Condamine (€53,801/m²). The gap between these three districts is now minimal, with only €107/m² separating them. A narrowing of price differences between districts was already visible last year, and this trend is confirmed in 2024: the spread (excluding Larvotto) has narrowed to €11,585, compared to €24,543 in 2023.

The rise in average resale prices by district has also been driven by the delivery in recent years of exceptional properties, which are now classified as resales — particularly in La Condamine (45G, Stella, Villa Portofino) and Jardin Exotique (L’Exotique, Monte-Carlo View). Looking ahead, Les Moneghetti is expected to follow this dynamic with the upcoming Villa Ninetta and Villa Lucia, while La Rousse, which has no new luxury developments in the pipeline, may see its prices stabilise.

We might refer to the past decade as one of contrasts. Over the last ten years, prices have increased the most in Jardin Exotique and La Condamine (+85%), while Monte-Carlo and La Rousse have seen more moderate growth (+32%). That said, these figures represent general trends rather than fixed reference prices by district. Significant variations still exist depending on the location — or even the building — particularly in Monte-Carlo and La Rousse, highlighting the unique nature of Monaco’s property market. As an example, Jardin Exotique posted a 36.5% rise in average price per square metre, largely driven by just three sales.

CONCLUSION

The year 2024 marks a new record for total residential transaction volume, reaching €5.9 billion — a figure that underscores the enduring appeal of Monaco’s property market. This performance comes despite the Principality’s inclusion on the Financial Action Task Force’s so-called “grey list”, which appears to have had little, if any, impact on the real estate sector.

A closer look, however, reveals a clear divergence between the dynamics of new developments and the resale market.

The new-build segment, which typically finds buyers well before completion, has been significantly boosted by the delivery of landmark projects such as Mareterra. This contributed substantially to market growth, with nearly €3.68 billion in sales recorded and an average sale price of €36 million.

These figures confirm the rise of “ultra-prime” real estate, focused on large layouts and meticulous finishes. This demand—clearly identified by developers—has led them, in their most recent deliveries, to adapt their offerings accordingly. Similarly, successful property traders have often merged several apartments into a single, very high-end unit.

This trend reflects the evolving profile of buyers, who are spending ever more time living in the Principality, no longer willing to compromise on space, and drawn to modern buildings offering a full range of services, just like in major Western capitals.

On the secondary market, however, the number of resales has fallen to a ten-year low (365). Despite this slowdown, the average price per square metre has remained above €51,000 for the fourth consecutive year—a testament to sellers’ resilience even in a more cautious environment in recent years. Sellers are rarely in a hurry and reluctant to reduce prices, even after several years on the market—a truly Monégasque characteristic.

In analysing the resale micro-market, one notes a very pronounced rise in prices in the Larvotto area, supported by the scarcity of available properties for sale, the complete renovation of the beach, and the opening of the new Mareterra district. 1-bedroom apartments have become the most sought-after typology for patrimonial investors, supplanting studios, while 2-bedroom apartments remain the most common family standard.

The first months of 2025 show signs of a sluggish but steady restart in the resale market. This recovery should accelerate—not necessarily this year, but in the medium term. Indeed, the short- and medium-term reduction in new-development deliveries will automatically bolster the dynamism of the second-hand market. Moreover, some of the new tenant-residents who moved in the Principality since 2021 may consider purchasing their primary residence.

The current economic climate—marked by falling key interest rates that favour financing, abundant liquidity among (U)HNW clients, and high volatility in financial markets driving many investors towards tangible assets—will encourage real-estate purchase projects.

Add to this the increasing fiscal pressure from European countries on their residents, together with political instability and security concerns, which all favour the relocation of great fortunes to Monaco.

These factors must be combined with the fact that the Principality contains only 17,000 residential lots/units—a drop in the ocean on an international scale—especially as the (U)HNW population attracted to Monaco grows significantly each year.

For all these reasons, we remain resolutely optimistic and will continue to champion Monaco with conviction—after all, we must never forget that we are its ambassadors.